Intro

The question of 2021 on everybody’s lips “What will the property market look like?” Should we expect to see house prices crash and will interest rates go up?

People are panicking about a recession, so far we’ve experienced awful quarters due to the coronavirus pandemic and the economy is looking rather damaged. But because the quarters have been so bad, it actually won’t take much to lift us out of a technical recession.

Now that doesn’t mean our economic activity is going to be anywhere near where we were back in March 2020 – before the full effects of Covid-19. We’re a little way off that yet I’m afraid.

So with a huge rise in unemployment, and the concern with whether interest rates will go up – what is the housing marketing going to look like?

Recession history

Thinking back to the early 1980s and again at the start of the 1990s, both of which I experienced, we’ve hit recessions before.

In the 80s mortgage interest rates rocketed to 15%! I was 18 and looking to purchase my first home in East Ham in London. Friends and family thought I was mad, but it didn’t matter to me that much.

I’d worked my back off saving up for a deposit the year before, and managed to amass a good amount of money, so my mortgage was relatively small.

Putting my hard-earned cash into renovating the flat I purchased for £9,000, after only a couple of years… the property tripled in value.

This was common across the board and the 80s were off, with most of the era experiencing a huge housing boom!

Fast forward to the early 90s and we’re dealing with the impact of having a comedy double act known as John Major and Norman Lamont in Government.

They joined us up with this European currency snake called the ERM (Exchange Rate Mechanism) and it was kind of an experimental forerunner to the Euro.

Interestingly from this recession and the one that took place in the 80s, unemployment rose to 10%. But it’s important to note that the property market did not crash!

Recession in 2021

Even the most pessimistic of forecasts only sees an unemployment rate of 7.5% – so not even reaching double digits. And where are the current interest rates? Not even sniffing at the 15% experienced in the 1980s.

Even though interest rates aren’t skyrocketing, there is still a lack of affordability. People can’t get mortgages but they still want to buy houses… Yes there’s a chance of house prices falling.

The two main catalysts to seeing house prices plummet in 2021 are:

- Mortgage rates becoming enormously high and unaffordable

- Unemployment rates increasing or not improving from where they are

We’ll come back to these two points later on.

What does the property market look like now?

There is a disproportionate level of unemployment across the spectrum. The difference across industries is vast and it’s the younger generation that is mostly affected.

Typically, those who fill roles such as shop floor workers, travel workers, flight attendants, hospitality workers, waiters, chefs, bar staff, etc. – Are relatively young and on relatively low wages compared with average salaries and salaries for more senior roles.

So taking this into account, it’s far less likely that people in their late teens and early twenties are looking to purchase a home this year. It’s going to be a bit more challenging for them to enter the property market. It will be those in professional positions within industries that are relatively secure, that are less inclined to face unemployment or huge reductions in income.

They are looking for houses, they can afford houses, so what reason is there for a big crash in house prices?

Will mortgage interest rates go up?

Money market specialists – the people that buy sterling forwards – are predicting in Q2 the second quarter of 2021, the Bank of England will send interest rates negative.

Now I know what you’re thinking, surely mortgages will never go to a negative interest rate? Could we get paid for borrowing money? That would never happen…

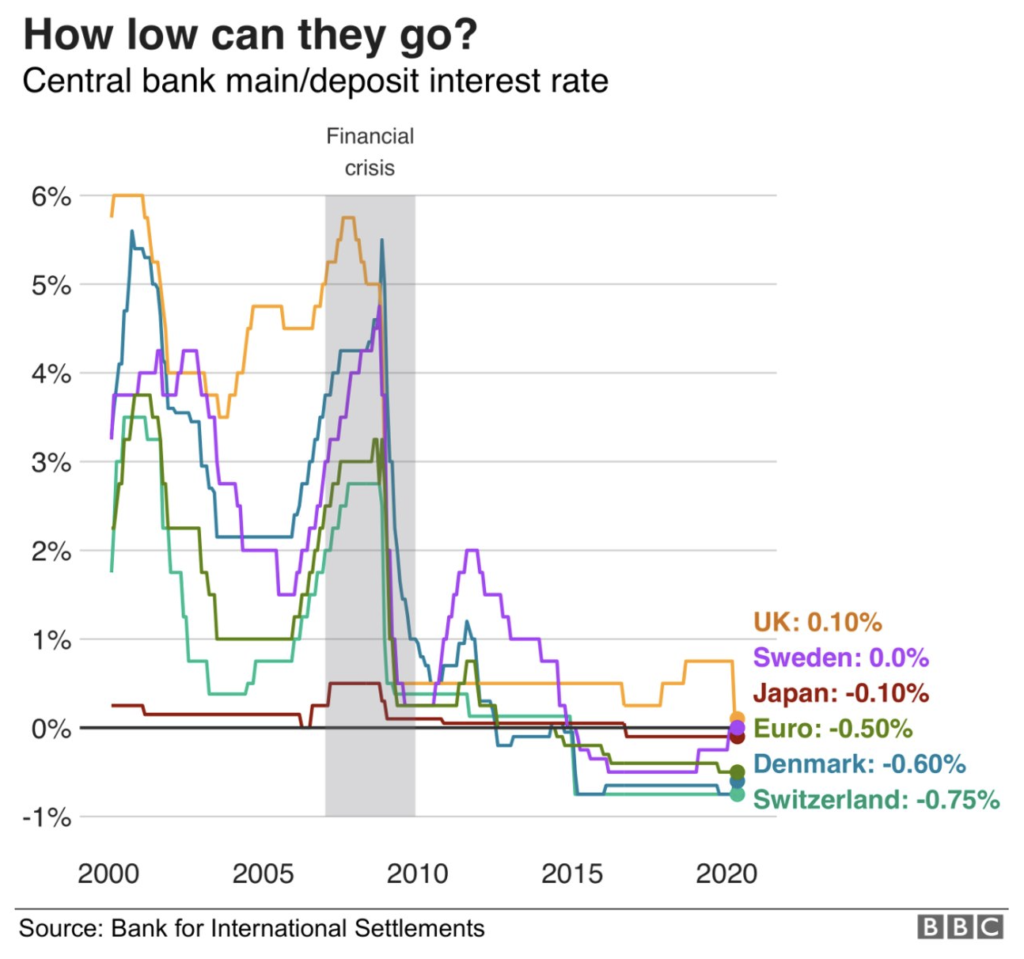

Well actually we’re seeing it in Denmark and Switzerland, take a look at the graph below. It’s not such a ludicrous thought at all.

What do you think will happen to the price of properties in the UK if interest rates do go down? After all, they are already incredibly low.

Every year we deal with the question of what interest rates will look like. We know they fluctuate annually. And there will always be discussions around it because some expert has said such and such meaning that house prices will crash – it’s a great way to fill columns inches in a newspaper that’s for sure!

Property demand and the effect on house prices

To keep up the pace with the population growth, the UK needed to build 200,000 new homes a year. Consistently for 20 years, this wasn’t done.

The clever clogs down in the house of cleverness in Westminster came up with a new plan recognising that “we are woefully short of the target we set ourselves so what we’ll do now is increase the target”.

Right ok, so instead of 200,000, they decided 300,000 would be better. We’ve never even been near the original number and no action was taken to get us close to that.

Their thinking must be that “if we increase the target, then look at the actual statistics, we look fine in regards to what we are achieving. We’ve fixed the problem, hoorah!”.

They’ve not done a sodding thing.

How many homes have been built as a result of this new target? None, zilch – we are still building 140,000 – 150,000 houses per year pretty much as we have done for the past 25 years.

The population continues to grow so the demand for houses continues to rise, and if there’s more demand than there are available houses – prices will inevitably go up!

For house prices not to go up, there needs to be an oversupply. And there is no evidence whatsoever that this will happen.

We know we are still dealing with a huge undersupply and more importantly, we know that there is no room to expand. I’m talking about the fact we are an island and we can’t build anymore land. We have to deal with the resources that are available to us.

Demand for more properties

We know that demand can affect whether house prices will crash. The ONS (Office for National Statistics) predicts that by 2029 the UK population will be 70 million.

The reasons being a combination of two things:

- An increase in birth rate. Taking into account the peak that will come from the coronavirus lockdown when everyone was stuck at home with not a lot to do…

- British overseas nationals coming to the UK from Hong Kong. For example, recent findings predict that over the next two years we can expect 1 million of them.

One million people over the next two years – that’s going to have a massive impact on demand and therefore house prices.

Other factors we must not forget are the fact that mortality rates are going up – people are staying in their homes for longer; couples are still sadly getting divorced – increasing the number of single households.

Considering the demographics and social measures right now, and what it’s likely to look like in the near future, not only will demand for housing increase, but it will do so at a very fast rate.

Demand for types of property

The final blow to anyone hoping for a property crash event is that being in lockdown has altered the kind of properties we want to buy.

Premium rental in London has dropped by up to 30%. People don’t want to live in small sardines cans with limited indoor space and no personal outdoor space including no garden.

City centre flats and apartments with balconies or close to outdoor spaces… haven’t gone down in value too much, but 3 or 4 bedroom houses with gardens and space to work from home have gone up.

We know that 25% of the UK’s workforce is now working from home, so there has been a shift in the type of property that people want to buy.

My answer to “what will the property market look like?

Well, we won’t see house prices crash, plunder and smash into nothingness across the board. However, we will see some reduction in house prices due to the types of homes being sought after.

But due to the continuously rising demand and lack of availability, it’s expected that overall prices in the property market are more likely to increase. And yes we may then see mortgage rates go up, but we’re not expecting them to soar to an entirely unaffordable level this year.

Interested in learning more?

Can’t wait to meet you there!