It’s a no-brainer, isn’t it?

Your house can’t earn a salary, but you can.

It’s not quite that simple…

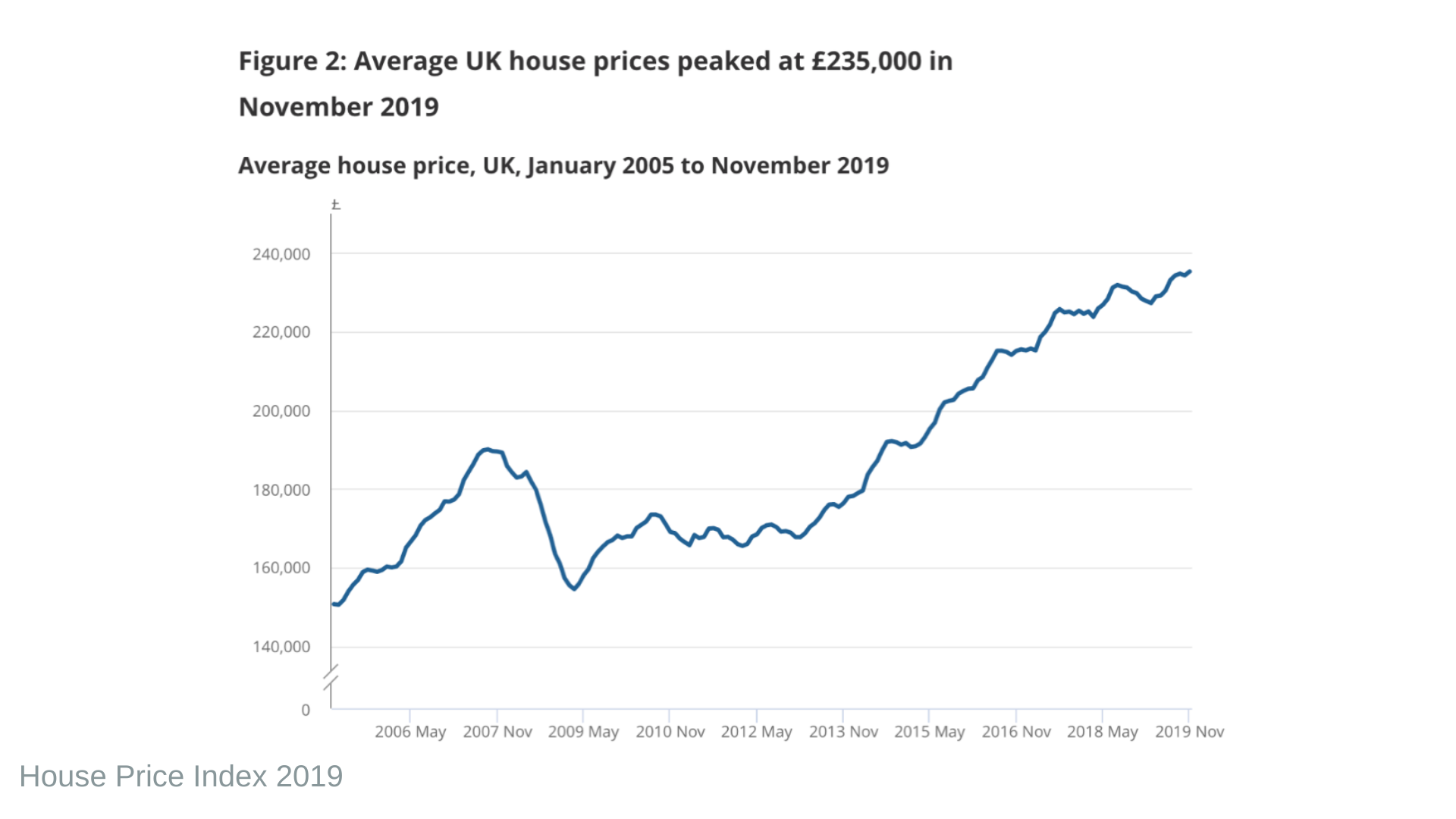

Let’s rewind to November 2019 when the pandemic hadn’t even crossed our minds.

The average house price has just peaked at £235,000 – the highest figure since January 2006. Statistics show us that the growth in property value has increased by 2.2% despite growing at a slower rate than in previous years.

Meanwhile the median salary sits at £30,378.

We don’t know that in the months to come, we’ll see the property market come to a stand still, people will be furloughed and the streets will become eerily quiet.

Now we’ve lived through it. And during this pandemic we’ve seen a huge rise in house prices.

We know income will drop for many people but the desire to move will still rise… So, we’re going to delve into the why’s of this property value boom and what this could mean for you as a property investor.

Does your house earn a better salary than you?

In order to answer this question we need to look at the facts. Here are 5 reasons why house prices are rising:

- A migration from urban to rural areas.

- Low borrowing costs.

- The stamp duty holiday.

- The increase in demand.

- The reduction in housing stock.

Together these factors are contributing to the increased value of properties. Here’s how –

Working from home has been the only viable way for business and life to continue. And it looks like it’s here to stay.

For employers, associated costs with running a business through an in-person office have decreased dramatically. For employees, commuting is no longer a massive issue: you can save time, money and brain space when your daily commute consists of walking downstairs and making a cup of tea.

This has led many to migrate from urban areas to rural locations, because an outdoor area, room for a desk and space to simply relax and breathe have become non-negotiables.

The pandemic has allowed many to rethink their priorities and in doing so, rethink where they’d like to live.

And demand increased exponentially when the government introduced the stamp duty holiday and low borrowing costs.

Although the stamp duty holiday only remains in place for properties under £150,000, property demand has shown no signs of slowing down. The problem is, we now have a huge reduction in housing stock: high demand with low supply.

As of April 2021, average house prices increased by over 8.9%.

The pressure on the property market has dramatically increased property prices.

What does this mean for you?

Well, we think that those already on the property ladder have made the best investments they will ever make: investing in property.

However, for those who haven’t yet, all is not lost.

Remember the house price growth formula: increasing demand plus declining housing stock?

With businesses and commerce moving online, many office spaces and shops remain unused, whilst residential property is in short supply.

Investing in commercial property could help to alleviate this problem: focus on converting commercial properties in sought after locations.

Buy in an area with strong rental demand and your property could be earning more than you!

In the following locations, properties have been earning more money per year than the people who own them – simply by existing.

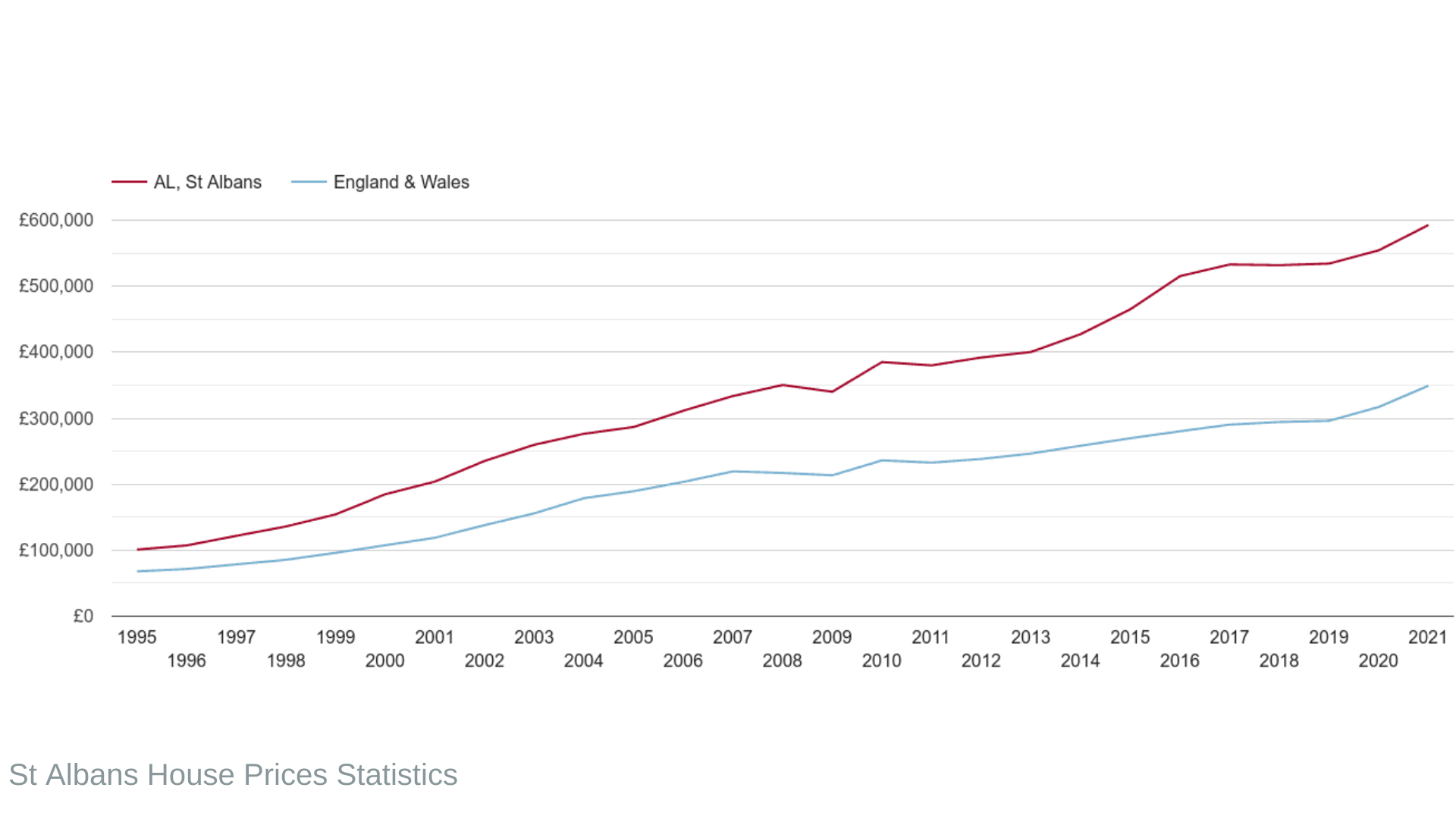

1. Commuter hotspots – St Albans in Hertfordshire

The average property is valued at £663,000 in St Albans, whilst the average salary sits at £42,600. Almost 50% of houses located in St Albans have increased in value by more than the average salary! This means that 24,000 homes have risen in value by more than £42,600.

2. Rural areas – Hastings in East Sussex

Hastings tops the ranks (scroll down to see the whole list!) for highest proportion of properties valued at more than the average salary:

The average salary of a worker in Hastings is £25,800, whilst the average house price is currently £285,000. Overall, 62% of homes in this location have increased in value by more than the average salary.

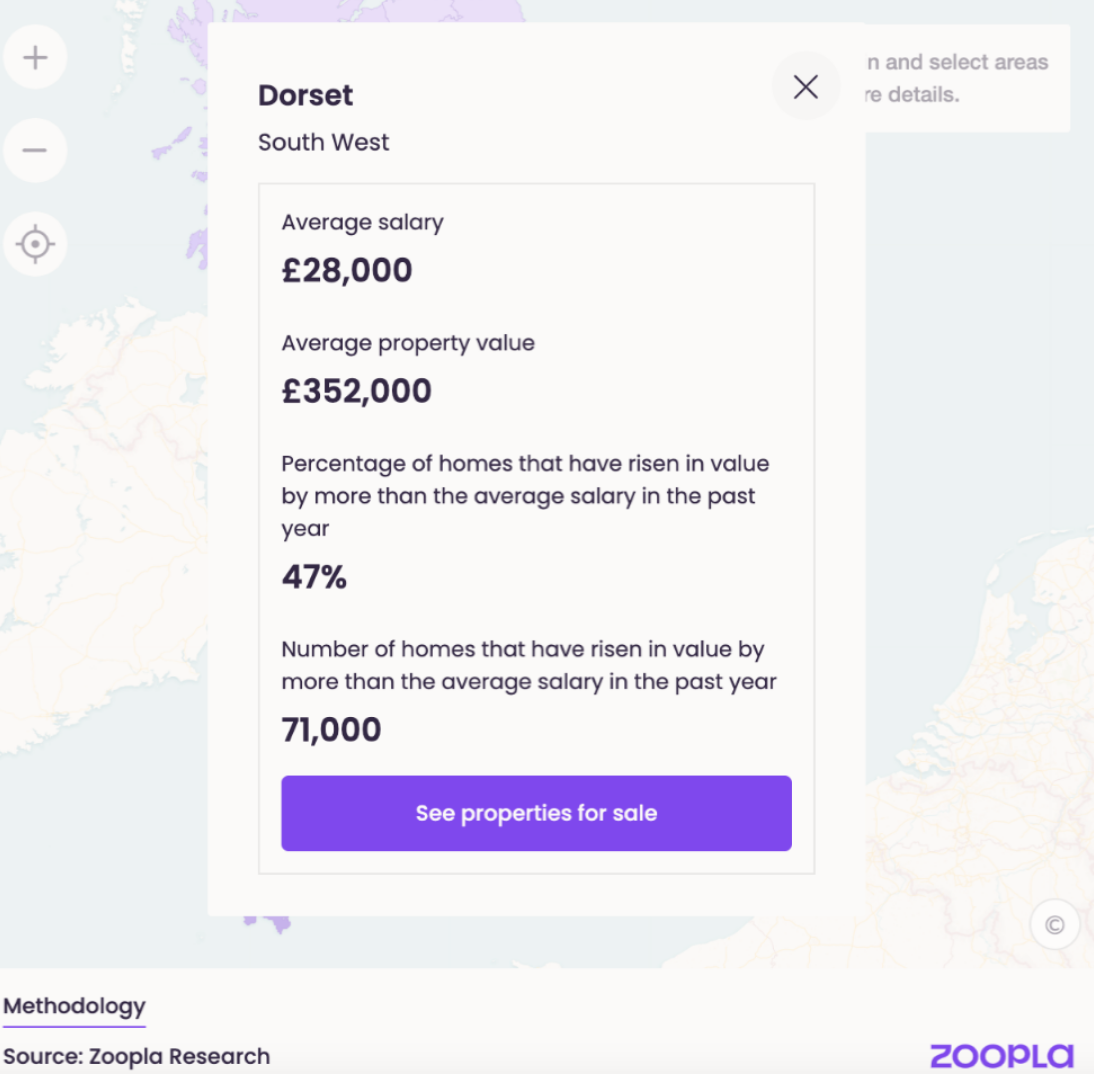

3. Coastal regions – Dorset

With the average salary of £28,000 for a worker living in Dorset, Zoopla estimates that 47% of properties in this location have risen in value by more than this average salary.

With house prices increasing, you don’t just have to sit tight. Help ease the decreasing housing stock whilst building your wealth through property investment.

Here’s the top ten areas we think you should focus on when searching for commercial property to convert: